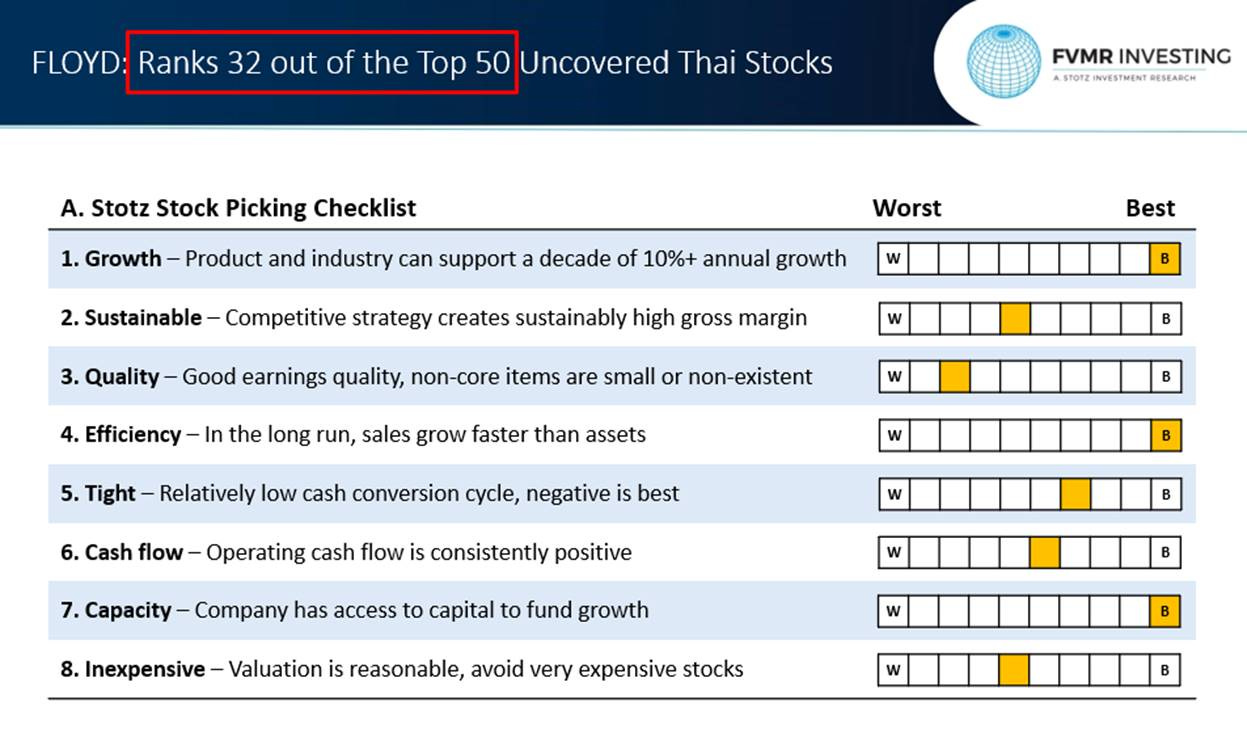

The A. Stotz Stock Picking Checklist

The dream outcome is to find hidden gems that can multiply in value.

คลิกเพื่ออ่านบทความฉบับภาษาไทย

The dream outcome of uncovered Thai stocks is to find hidden gems that can multiply in value. Many years ago, we read the book 100 Baggers: Stocks That Return 100-to-1 and How To Find Them by Christopher W Mayer. Mr. Mayer was also a guest on Dr. Stotz’s podcast.

Inspired by the book and that conversation, using our FVMR framework, we set out to test what factors stocks that multiply in share price have in common. While finding stocks that return 100x might be a bit audacious, finding stocks that return 3-10x should be possible.

Eight common characteristics of stocks that have multiplied in value

From our research, we identified eight common characteristics of stocks that have multiplied in value. From that, we created the A. Stotz Stock Picking Checklist:

1. Growth – Product and industry can support a decade of 10%+ annual growth

2. Sustainable – Competitive strategy creates sustainably high gross margin

3. Quality – Good earnings quality, non-core items are small or non-existent

4. Efficiency – In the long run, sales grow faster than assets

5. Tight – Relatively low cash conversion cycle, negative is best

6. Cash flow – Operating cash flow is consistently positive

7. Capacity – Company has access to capital to fund growth

8. Inexpensive – Valuation is reasonable, avoid very expensive stocks

Let’s look into the eight items one by one.

1. Growth – Product and industry can support a decade of 10%+ annual growth

Every business starts with sales; without it, a company eventually dies. For the value of a business to grow, sales need to grow. Without sales growth, don’t expect any extended increase in share price.

In the past 30 years, the annual revenue growth of all non-financial companies worldwide was 5.8%. So, to outperform, a company needs to grow at 10% or more per year. To grow sales at double digits each year for a decade, it generally requires the business to be in a growing industry. Mature industries rarely see that kind of growth sustained.

2. Sustainable – Competitive strategy creates sustainably high gross margin

A high and stable or improving gross profit margin is the financial evidence of a company’s competitive advantage. A high gross profit margin indicates that the company has pricing power or superior cost efficiency, which rivals cannot easily replicate. This competitive advantage is necessary to prevent competition from eroding the high returns on capital needed for multi-year compounding.

3. Quality – Good earnings quality, non-core items are small or non-existent

Earnings quality ensures that the reported profit truly represents the underlying performance of the business. A reliance on non-core, one-time gains, or aggressive accounting practices (high accruals) provides an unreliable foundation for long-term price appreciation. High-quality earnings, which closely track cash flow, are more predictable and persistent.

4. Efficiency – In the long run, sales grow faster than assets

It tells us the amount of revenue the company generates from its existing assets. Getting more revenue from a company’s assets relative to peers shows that management is better at generating output from their assets. Careful asset growth that is matched with revenue growth preserves the company’s capital. Companies that must constantly spend heavily on assets just to grow sales will have lower incremental returns and a slower compounding rate.

5. Tight – Relatively low cash conversion cycle, negative is best

The cash conversion cycle (CCC) measures how long a company’s cash is tied up in its working capital. A low or negative CCC, where cash is received from customers before the company pays suppliers, indicates that the business is highly efficient and essentially receives free financing from its vendors. This provides an immediate, cost-free source of capital to fund growth.

6. Cash flow – Operating cash flow is consistently positive

Consistently positive operating cash flow is the lifeblood of a healthy business. It confirms that the business model is self-sustaining and generating real cash from its core operations. It provides the necessary funding for capital expenditures, debt payments, and reinvestment in growth opportunities without needing constant dilution or debt.

Operating cash flow is also viewed as a higher-quality metric than net income because it is less susceptible to management manipulation via accounting accruals, giving investors greater confidence in the reported performance.

7. Capacity – Company has access to capital to fund growth

While self-funding via operating cash flow is ideal, all high-growth companies—especially at the small-cap stage—will eventually need capital to scale, invest in large projects, or make acquisitions. Access to capital (via low-cost debt or equity) ensures the company is not financially constrained and can aggressively pursue opportunities. A listed company with low or negative net debt can generally access funding more easily and cheaply.

8. Inexpensive – Valuation is reasonable, avoid very expensive stocks

Buying a stock at a reasonable (or cheap) valuation is crucial because it allows the valuation multiple to expand as the company demonstrates its growth story. Starting with a very high multiple may create a strong headwind. It’s worth noting that investors pay for future growth, so a stock with high growth potential might catch up with or even outpace its multiple if the growth opportunities materialize.

Creating a quant model using the FVMR framework

The eight items on the A. Stotz Stock Picking Checklist are common characteristics of stocks that have multiplied in value. However, we need to identify these stocks before they multiply in value to make money from them as investors.

Based on the A. Stotz Stock Picking Checklist, we did backtesting to come up with our quantitative model. We use our proprietary FVMR framework to create all our quantitative models. FVMR stands for Fundamentals, Valuation, Momentum, and Risk – the sources of investment returns.

First, we needed to test various measures that could represent each factor. For example, “2. Sustainable – Competitive strategy creates sustainably high gross margin” can be measured in many ways, such as by absolute gross margin, gross margin relative to others, and volatility in gross margin. The measure that has historically been the best predictor of future returns was kept.

When we have identified the best measure for each factor, we test the combination of factors. Developing quantitative models for 15+ years, we’ve learned that more factors aren’t always better. So, we test various combinations of factors to determine the final model.

We have optimized the model for the highest forward return and success rate (how often the model picks the right stocks). There are, of course, no guarantees in investing.

What the quantitative model tells us – no guarantees

The quantitative model tells us that there are stocks in the Top 50 that have a higher likelihood of outperforming the market. In our reports, we show you the subject company’s rank within the Top 50. In the example below, FLOYD ranked 32 out of the Top 50. We also decile rank the company, from best (B) to worst (W), on all eight factors on the A. Stotz Stock Picking Checklist. The decile rank is relative to all other stocks in the universe (typically about 250 stocks).

While not all stocks in the Top 50 will outperform, our quantitative model tells us they have a higher probability of outperformance than other stocks in the universe. Generally, a higher rank means a higher probability of outperforming, so being ranked 3 is better than being ranked 30. But note the word “probability.” Keep in mind that even an event that has an 80% probability of occurring fails to happen 20% of the time.

The uncovered Thai stocks universe and identifying the Top 50

The universe excludes companies in the Financials sector and REITs, and consists only of Thai stocks lacking formal analyst coverage from brokers or research houses. Stocks in the universe are required to have at least US$5,000 (~Bt160K) in average daily turnover in the past three months. The stock must have a CGR rating of 3+ in the Corporate Governance Report of Thai Listed Companies by the Thai Institute of Directors and must not be marked CB, CS, CC, CF, or SP, nor have a qualified opinion from the auditor, nor be under formal accusation by the SEC. Based on these criteria, the universe typically includes around 250 stocks.

To come up with the final Top 50 companies to produce reports on each quarter at Uncovered Thai Stocks, we rank all stocks in the universe based on our quantitative FVMR model. We then quality check the model output by reviewing the financial statements of the companies.